Title Tthe bailout:plan:As credit markets thaw, rates should also begin to fall oncredit default swaps. published to livewriter-onscreen.

Report sent to livewriter-onscreen. about Tthe bailout:plan:As credit markets thaw, rates should also begin to fall oncredit default swaps.

This article is located at livewriter-onscreen.

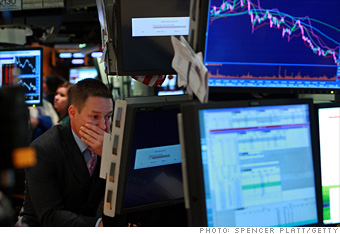

So, how exactly will we know if the credit clog is breaking up? Some of the banking industry's first responses won't be immediately visible to most Americans, but they are critical to the proper functioning of the U.S. financial system. For instance, a drop in a crucial short-term lending rate called the London Interbank Offered Rate, or Libor, would be a telltale sign that banks are less anxious about extending credit to each other — and the rest of us. Libor is the rate many banks pay for the short-term loans essential to their daily operations. It's also the base rate for an enormous amount of commercial lending and for many adjustable-rate mortgages. Another sign of growing confidence in financial markets would be lower rates on "commercial paper," a crucial short-term borrowing mechanism that many companies rely on for financing day-to-day operations, including payrolls and other expenses. Economists said a properly designed bailout should also cause interest rates on Treasury securities to rise relatively quickly. If that happens, it would signal that investors — who have been flocking to Treasurys because of their perceived safety relative to other investments — are more willing to bet on riskier types of debt and securities. "The recovery process is going to come in stages, not in one fell swoop," said Terry Connelly, dean of Golden Gate University's Ageno School of Business. "The credit markets had a stroke. We are in intensive care now. We will have to learn how to walk and talk again." As credit markets thaw, rates should also begin to fall on a type of corporate-debt insurance known as credit default swaps. While not a household word, these derivatives figured prominently in the country's financial crisis. Prices for credit default swaps soared in the aftermath of the Lehman Brothers' bankruptcy and pushed American International Group Inc., a major insurer of this kind of corporate debt, into the hands of the government following an $85 billion emergency loan funded by taxpayers. Assuming these more obscure corners of the financial markets are on solid footing again, consumers should eventually begin to have an easier time taking out loans for homes, cars, furniture and college. Over time, a healthier financial system should help the value of the dollar rise versus other currencies, reflecting renewed confidence in the U.S. economy and blunting inflationary pressures that have made Americans feel less wealthy. But it is only after a wide range of industries feel confident that the economic and financial conditions have fully recovered that they will start to ramp up hiring, perhaps by 2010. House prices should stop falling in the summer of 2009 and may start rising in 2010, economists said.

The details of the bailout deal

From Office of Speaker Nancy Pelosi -- Sept. 28, 2008

REINVEST,

REIMBURSE,

REFORM

IMPROVING THE FINANCIAL RESCUE LEGISLATION

Significant bipartisan work has built consensus around dramatic improvements to the original Bush-Paulson plan to stabilize American financial markets -- including cutting in half the Administration's initial request for $700 billion and requiring Congressional review for any future commitment of taxpayers' funds. If the government loses money, the financial industry will pay back the taxpayers.

3 Phases of a Financial Rescue with Strong Taxpayer Protections

# Reinvest in the troubled financial markets … to stabilize our economy and insulate Main Street from Wall Street

# Reimburse the taxpayer … through ownership of shares and appreciation in the value of purchased assets

# Reform business-as-usual on Wall Street … strong Congressional oversight and no golden parachutes

CRITICAL IMPROVEMENTS TO THE RESCUE PLAN

Democrats have insisted from day one on substantial changes to make the Bush-Paulson plan acceptable -- protecting American taxpayers and Main Street -- and these elements will be included in the legislation

Protection for taxpayers, ensuring THEY share IN ANY profits

# Cuts the payment of $700 billion in half and conditions future payments on Congressional review

# Gives taxpayers an ownership stake and profit-making opportunities with participating companies

# Puts taxpayers first in line to recover assets if participating company fails

# Guarantees taxpayers are repaid in full -- if other protections have not actually produced a profit

# Allows the government to purchase troubled assets from pension plans, local governments, and small banks that serve low- and middle-income families

Limits on excessive compensation for CEOs and executives

New restrictions on CEO and executive compensation for participating companies:

# No multi-million dollar golden parachutes

# Limits CEO compensation that encourages unnecessary risk-taking

# Recovers bonuses paid based on promised gains that later turn out to be false or inaccurate

Strong independent oversight and transparency

Four separate independent oversight entities or processes to protect the taxpayer

# A strong oversight board appointed by bipartisan leaders of Congress

# A GAO presence at Treasury to oversee the program and conduct audits to ensure strong internal controls, and to prevent waste, fraud, and abuse

# An independent Inspector General to monitor the Treasury Secretary's decisions

Transparency -- requiring posting of transactions online -- to help jumpstart private sector demand

# Meaningful judicial review of the Treasury Secretary's actions

Help to prevent home foreclosures crippling the American economy

# The government can use its power as the owner of mortgages and mortgage backed securities to facilitate loan modifications (such as, reduced principal or interest rate, lengthened time to pay back the mortgage) to help reduce the 2 million projected foreclosures in the next year

# Extends provision (passed earlier in this Congress) to stop tax liability on mortgage foreclosures

# Helps save small businesses that need credit by aiding small community banks hurt by the mortgage crisis—allowing these banks to deduct losses from investments in Fannie Mae and Freddie Mac stocks

The administration had initially requested virtually unfettered authority to operate the bailout program. But as they moved toward clinching a deal, both sides appeared to have given up a number of contentious proposals, including a change in the bankruptcy laws sought by some Democrats to give judges the authority to modify the terms of first mortgages.

A senior administration official, who requested anonymity to speak freely about the plan, said both sides had made significant concessions to achieve compromise. The Bush administration has agreed to accept a number of Democratic demands, including: · The money would be dispersed in segments, with Paulson receiving $250 billion immediately, $100 billion upon White House certification of its necessity and the final $350 billion only after Congress has been given 15 days to object. · Firms participating in the bailout would be required to grant the government warrants to obtain nonvoting shares of stock, so taxpayers can benefit if the companies return to profitability. · Firms taking advantage of the bailout would be required to limit compensation for senior executives, with especially severe limits on "golden parachutes" at failing firms. The compensation limits will be enacted primarily, but not solely, through the tax code by reducing tax deductions for firms that pay executives more than $500,000 a year. The administration also agreed to Democratic demands that the financial services industry should help pay for the program. Under the agreement, the president would be required to propose a fee on the industry if the government has not recovered its money through sales of the assets within five years. Democrats also made a number of concessions, abandoning demands that bankruptcy judges be empowered to modify home mortgages on primary residences for people in foreclosure. They also agreed not to dedicate a portion of any profits from the bailout program to an affordable housing fund that Republicans claimed would primarily assist social service organizations that support the Democratic Party, the official said. Meanwhile, House Republicans won a major victory, persuading negotiators to include a provision that would require the Treasury Department to create a federal insurance program that would guarantee banks and other firms against loss from any troubled asset, the official said. The plan to rescue the U.S. financial markets was first advanced by the Bush administration in a late-night meeting with lawmakers just 10 days ago. Under the proposal, Paulson would be authorized to purchase mortgage-backed assets from struggling firms in hopes of easing a credit crunch that has pushed global markets to the brink of collapse. With home prices plummeting, many of those assets are now almost worthless, and investors have lost confidence in many of the firms that hold them. That has undermined some of the biggest names on Wall Street and caused banks to stop lending money, sparking a credit crisis that threatens to deliver a devastating blow to businesses, consumers and the broader economy. Administration officials have stressed that the ultimate cost of the bailout would be much less than $700 billion because the government would eventually sell the assets it purchased and recover most, if not all, of its investment. Yesterday's talks, conducted mainly in Pelosi's suite of offices on the second floor of the Capitol, were focused heavily on how to cover the cost of the program so taxpayers don't get stuck with the bill. "We believe that the taxpayer should not be left holding the bag at the end of the day, and we've proposed a way to address that," said Rep. Chris Van Hollen (D-Md.), a member of Pelosi's leadership team. Democrats said there were no outstanding issues remaining, but that negotiators need to see the words on paper before they can sign off on the plan. "It's really a question of seeing what we believe we've agreed to," said Sen. Christopher J. Dodd (D-Conn.), chairman of the Senate Banking Committee. Even strong opponents of the plan said they expected it to pass. Sen. Richard C. Shelby (R-Ala.), the senior Republican on the Senate Banking Committee, who has refused to participate in the talks, said a "critical mass" was forming behind the measure because of fears that Congress's failure to act would cripple financial markets and devastate the economy. Yesterday's negotiations, which began shortly after 3 p.m., were at times tense and confusing, according to participants. At one point, according to Sen. Kent Conrad (D-N.D.), one senator sought advice from investor Warren E. Buffett, one of the world's richest men and a director of The Washington Post Co. From 3 p.m. to 5:30 p.m., Conrad and other lawmakers met with Paulson around a massive table in Pelosi's conference room under an ornate portrait of Abraham Lincoln. Among lawmakers, Democrats outnumbered Republicans nine to two, an imbalance that so irritated Paulson that he called and complained to Senate Majority Leader Harry M. Reid (D-Nev.), according to three GOP sources familiar with the call. Reid told Paulson he would not pull any of his colleagues out of the meeting. A Reid spokesman, Jim Manley, said: "If the secretary doesn't like it, that's just too bad, because he is going to need the help of each and every one of them to sell the president's plan to the Democratic caucus and the American people." After a break for dinner, the sides scattered into at least three separate groupings -- Paulson huddled in House Minority Leader John A. Boehner's office with other GOP leaders, Democrats in Pelosi's conference room and Pelosi in a separate suite talking with other Democrats. Rep. Rahm Emanuel (D-Ill.) and Pelosi's chief of staff spent a couple of hours in shuttle diplomacy, frantically walking from room to room carrying sheets of paper. Conrad, the chairman of the Senate Budget Committee, said the negotiators were "shopping language" of the bill's draft versions. He and Rep. Barney Frank (D-Mass.), chairman of the House Financial Services Committee, also spent time in Boehner's office with Paulson. By 11 p.m., the three groups had once again converged in Pelosi's office to strike a final deal. Yesterday's focus on limiting taxpayer exposure may help rally support in Congress, where lawmakers have been reluctant to back the hugely expensive and unpopular bailout measure less than six weeks from the November elections. But it could unnerve Wall Street, where investors are seeking the largest possible program with the fewest strings attached. They also hope lawmakers approve it before tomorrow's opening bell. In his public testimony and private remarks, Paulson has repeatedly emphasized the need to spend $700 billion to soothe nervous markets. At that price, the government's upfront investment in the rescue package would be more expensive than the current cost of the Iraq war, which stands at about $650 billion, according to the Congressional Research Service. But the White House and politicians on Capitol Hill have said the government could earn back much of its money, or even turn a profit. "Many of these assets still have significant underlying value, because the vast majority of people will eventually pay off their mortgages," President Bush said yesterday in his weekly radio address. "In other words, many of the assets the government would buy are likely to go up in price over time. This means that the government will be able to recoup much, if not all, of the original expenditure." Bush attempted to address criticisms from the right and left that the plan would bail out irresponsible financiers while doing nothing for regular Americans. Echoing frequent comments by him and his aides, Bush said allowing Wall Street to collapse further would pose greater dangers to the economy, perhaps triggering a "deep and painful recession."

Loans - particularly those made from one bank to another - would be more available and less expensive in a matter of days, if not weeks. And as the government gobbles the banks' toxic assets, the industry would gain the confidence and strength needed to make it easier and cheaper for families to borrow for homes, cars and college - and for businesses to secure ample debt to pay for plants, equipment and workers. Still, rising unemployment, high energy prices and falling real estate values will not disappear overnight. "At first, there will be some sort of sigh of relief, which I'm afraid would be misplaced, because when you get through the shorter-term terror, you're left with an economic landscape that will be very fragile," said Michael Farr, president of Farr, Miller & Washington, which manages investment portfolios for people and businesses. Were the clogged credit markets of the past year - and more crucially, the past few weeks - left to fester without a massive government intervention, the United States faced a financial calamity that could have plunged the economy into a deep recession, putting the livelihoods and investments of millions of ordinary Americans at risk, President Bush and Federal Reserve Chairman Ben Bernanke warned. "Bernanke told us that our American economy's arteries, our financial system, is clogged, and if we don't act, the patient will surely suffer a heart attack maybe next week, maybe in six months, but it will happen," said Sen. Chuck Schumer, D-N.Y., chairman of Congress' Joint Economic Committee. Once the liquidity floodgates have been opened - the government will have as much as $700 billion at its disposal to buy banks' bad mortgages and other rotten assets - the benefits of the bailout proposed by Treasury Secretary Henry Paulson and modified by Congress are expected to trickle down through the rest of the economy. But Americans should be braced to feel economic pain well into next year. More people will lose their jobs, foreclosures will go up, paychecks will be strained and home values - people's single biggest asset - will keep falling, experts predict. Even if the plan is successful, many predict the economy will probably shrink in the final quarter of this year and in the first quarter of next year, meeting the classic definition of a recession. The unemployment rate - now at a five-year high of 6.1 percent - is expected to hit 7 or 7.5 percent by late 2009. That would be the highest jobless rate since after the 1990-91 recession. So, how exactly will we know if the credit clog is breaking up? Some of the banking industry's first responses won't be immediately visible to most Americans, but they are critical to the proper functioning of the U.S. financial system. For instance, a drop in a crucial short-term lending rate called the London Interbank Offered Rate, or Libor, would be a telltale sign that banks are less anxious about extending credit to each other - and the rest of us. Libor is the rate many banks pay for the short-term loans essential to their daily operations. It's also the base rate for an enormous amount of commercial lending and for many adjustable-rate mortgages. Another sign of growing confidence in financial markets would be lower rates on "commercial paper," a crucial short-term borrowing mechanism that many companies rely on for financing day-to-day operations, including payrolls and other expenses. Economists said a properly designed bailout should also cause interest rates on Treasury securities to rise relatively quickly. If that happens, it would signal that investors - who have been flocking to Treasurys because of their perceived safety relative to other investments - are more willing to bet on riskier types of debt and securities. "The recovery process is going to come in stages, not in one fell swoop," said Terry Connelly, dean of Golden Gate University's Ageno School of Business. "The credit markets had a stroke. We are in intensive care now. We will have to learn how to walk and talk again." As credit markets thaw, rates should also begin to fall on a type of corporate-debt insurance known as credit default swaps. While not a household word, these derivatives figured prominently in the country's financial crisis. Prices for credit default swaps soared in the aftermath of the Lehman Brothers' bankruptcy and pushed American International Group Inc., a major insurer of this kind of corporate debt, into the hands of the government following an $85 billion emergency loan funded by taxpayers. Assuming these more obscure corners of the financial markets are on solid footing again, consumers should eventually begin to have an easier time taking out loans for homes, cars, furniture and college. Over time, a healthier financial system should help the value of the dollar rise versus other currencies, reflecting renewed confidence in the U.S. economy and blunting inflationary pressures that have made Americans feel less wealthy. But it is only after a wide range of industries feel confident that the economic and financial conditions have fully recovered that they will start to ramp up hiring, perhaps by 2010. House prices should stop falling in the summer of 2009 and may start rising in 2010, economists said. In the short term, there are several economic reports to watch for clues about whether credit conditions are improving: • The Federal Reserve's quarterly senior loan officers' survey, which tracks banks' appetite to lend; • The Fed's weekly report on emergency loans provided to banks and investment firms; • Freddie Mac's weekly report on mortgage rates; • The Mortgage Bankers Association's quarterly survey of home foreclosures and delinquencies. The heart of the bailout plan gives the government authority to relieve financial institutions of the distressed mortgages and other bad assets on their books. Getting dodgy assets off the books of hobbled banks will make it easier for them to attract fresh capital and boost lending. As Lehman, AIG and other major financial companies racked up huge losses and saw more coming, credit problems spread globally, firms hoarded cash and they all clamped down on lending. That crimped consumer and business spending, and dragged down the economy - a vicious cycle Washington lawmakers hope to break with this historic bailout. "It's just a huge negative psychology that will be hard to turn around," said William Dunkelberg, chief economist for the National Federation of Independent Business and an economics professor at Temple University. Adds Sean Snaith, economics professor at the University of Central Florida: "If someone slights you today, it is going to be hard to immediately e for that confidence to be restored."

Videos from YouTube

Title: Bill Clinton On The Bailout

Categories: News,global,clinton,bailout,bill,bank,

Published on: 9/25/2008 7:42:59 AM

Title: Let's Play "WALLSTREET BAILOUT" The Rules Are... Rep Kaptur

Categories: military,economy,congress,taxcuts,gitmo,habeas,News,congresswoman,relief,mama,bush,kaptur,iraq,cheney,bill,corpus,

Published on: 9/22/2008 8:03:52 PM

Title: Congressman Ron Paul Schools Bernanke on the Bailout Plan

Categories: Price,Monetary,Wall,Bail,Constitutionality,News,Bailout,Ron,Bernanke,Street,Out,Authority,Debt,Fixing,Federal,Paul,Depression,

Published on: 9/24/2008 11:32:51 AM

Title: Ron Paul Fox News 9/17/08 AIG bailout

Categories: News,Fox,Baldwin,Ron,McKinney,News,Paul,Nader,

Published on: 9/17/2008 3:23:30 PM

Title: This Is How The Bail Out Will Screw You

Categories: bad,paulson,pay,off,economy,bailou,the,henry,News,loans,money,street,john,bush,financial,treasury,loan,turks,crisis,wall,republicans,mccain,young,hank,administration,secrretary,

Published on: 9/22/2008 9:44:53 PM

No comments:

Post a Comment